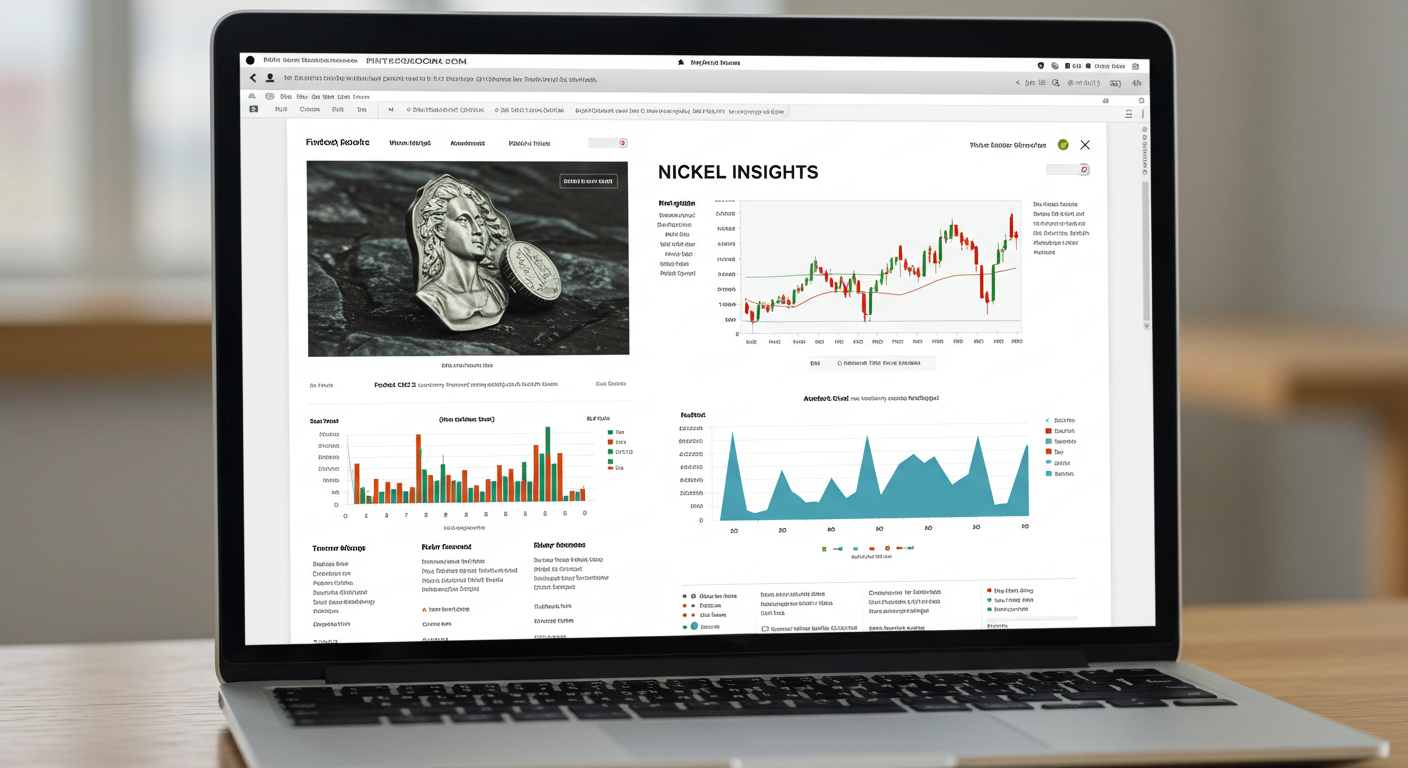

The nickel market is buzzing, and FintechZoom.com is here to guide you through its intricacies. With demand for nickel at an all-time high due to its critical role in electric vehicle (EV) batteries and sustainable technologies, the market is seeing rapid changes. Whether you’re an investor, trader, or finance enthusiast, understanding these trends is crucial to staying ahead.

This post dives into the latest nickel market insights, focusing on price trends, influencing factors, and what FintechZoom.com offers to help you stay informed.

Why Nickel Is a Key Commodity

Nickel is essential not only for stainless steel production but also for the growing green energy revolution. It is a crucial component in lithium-ion batteries used in EVs, which has driven its demand significantly over the past decade. According to market analysts, the push for cleaner energy solutions will continue elevating nickel’s importance on the global stage.

But this increased demand comes with increased market volatility. Long-term investors must keep a keen eye on price fluctuations and factors impacting supply and demand.

Current Nickel Market Trends

1. Global Demand Rising

Nickel demand continues to grow as car manufacturers ramp up EV production to meet emissions targets and consumer demand. By 2030, it’s expected that 70% of global nickel will be used for battery production.

2. Market Volatility

Global geopolitical tensions and supply chain disruptions continue to create uncertainty in the nickel market. For instance, Indonesia, the largest nickel producer, has imposed export restrictions on raw nickel to spur domestic EV battery production. These policies have rippled through global supply chains, intensifying price volatility.

3. Sustainable Mining on the Rise

Sustainability is becoming a more significant factor in nickel mining. Companies and governments are placing a more considerable emphasis on ethical sourcing and carbon-neutral extraction, which could affect pricing structures moving forward.

4. Price Movements

Recent data shows that nickel prices have been fluctuating significantly in 2025, reflecting both increased demand and unpredictable supply constraints. Staying updated on real-time pricing will be essential for decision-making.

FintechZoom.com offers live price updates for nickel, along with detailed analyses to help investors interpret market movements and trends.

Factors Driving Nickel Prices

Demand

- EV Battery Production: With Tesla, BYD, and other manufacturers requiring significant nickel quantities, the demand is soaring.

- Infrastructure Projects: Stainless steel’s role in construction is driving secondary demand globally.

Supply

- Export Restrictions in Major Producing Countries: Key nickel-producing nations like Indonesia are exerting control over exports.

- Mining Output Challenges: Sustainability practices and logistical roadblocks lead to constrained supply networks.

Global Economic Factors

- Inflation and Recession Fears: Rising interest rates globally have created hesitations in the commodities market.

- Currency Fluctuations: A strong US dollar can exert downward pressure on prices for dollar-denominated commodities like nickel.

How FintechZoom.com Keeps You Updated

At FintechZoom.com, staying ahead of market trends is our priority. Here’s how we help you make informed decisions in the nickel market:

- Live Nickel Price Updates: Receive real-time price movements and in-depth analyses.

- Market Trend Reports: Access expertly curated data and insights.

- Investor Tools: Use our financial instruments to evaluate risks and identify opportunities.

Additionally, FintechZoom.com covers detailed commodities, forex, and equity market trends beyond nickel, ensuring you’re always equipped with comprehensive information.

Why Trust FintechZoom.com?

FintechZoom.com has earned credibility over the years as a reliable source for financial insights, offering content tailored to professionals, investors, and companies alike. Our niche expertise across global markets ensures accuracy, relevance, and depth in every resource we provide.

With the nickel market growing more vital in today’s green economy, leveraging cutting-edge resources like FintechZoom’s market data ensures you stay competitive. Keep up with today’s trends, anticipate tomorrow’s changes, and make informed investment decisions with us.

What the Nickel Market Means for You

The rise of nickel reflects a broader shift toward sustainable energy solutions. Investors seeking to capitalize on the booming EV industry must understand nickel’s emerging role. Whether you’re actively trading commodities or looking into long-term investments, awareness of global nickel trends will be key to maximizing opportunities.

We encourage you to visit FintechZoom today to access live market updates and expert-driven nickel market analyses. Stay ahead in the rapidly evolving global commodities landscape.

Suggested Next Steps:

- Bookmark FintechZoom’s Nickel Section for real-time updates.

- Explore how global markets influence the nickel industry.

- Use FintechZoom.com’s tools for deeper market insights and projections.

Leave a Reply